Singapore boasts of a vibrant start-up ecosystem that serves as a breeding ground for entrepreneurship. It is a dream destination for enthusiasts who want to make their business presence known in the international market. Every year, the city-state witnesses a massive influx of entrepreneurs who indulge in company registration Singapore to set up their businesses. The role of its government in building this reputation of the Republic can not go unnoticed. The Singapore government has rolled out a series of cash grants, incubator schemes and equity programs to provide succor to the budding entrepreneurs.

Why Singapore Government Encourages Entrepreneurship?

The pro-business Singapore government is credited with the success of the nation as “Entrepreneurial Hub.” Despite no natural resource, how Singapore could manage to become one of the prosperous and rich economies in the world? This question often swirls in the minds of everyone. And, it is the prominence of trading and financial business sectors in the shore of the island nation, which make the economy strong and robust.

This is the reason why the government of the city-state continues to lure the potential entrepreneurs across the globe to incorporate a company in Singapore by imposing business-friendly policies, forward-looking economic policies, and progressive tax regimes.

Singapore Company Registration – Why it appeals the Enthusiasts most?

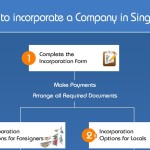

In a bid to attract more foreign investment to the nation, the government has made the process of Singapore company registration simple, straight-forward and fast. There is no restriction on foreign ownership of business in Singapore.

Only two steps involved in the process of company incorporation- 1) company name approval and 2) company registration (filing of the application form). The process of company registration Singapore should not take much time unless the application is forwarded to referral authority.

The prestigious World Bank report (2017) has ranked Singapore 2nd on “Ease of Doing Business.” This accolade serves as a testimony to Singapore’s reputation of being the easiest place for doing business in the world.

What are the Best Government Grants for Start-up Business in Singapore?

Capital Fund is the lifeblood of any business. It is as essential as the other key ingredients of the business. The best government-backed grants for start-up business are given hereunder:

ACE Startup Grant

ACE (Action Community for Entrepreneurship) in collaboration with Singapore government agency SPRING provide a grant for supporting the first-time entrepreneur who is a Singapore Citizen or Permanent Resident. For every S$3 raised by the entrepreneur, ACE will match it with S$7. The amount extended by ACE is capped at S$50,000.

Eligibility to avail the grant will be based on criteria that include differentiation, business model viability, potential market opportunity, and management team. The company of the applicant should not be older than six months at the time of submitting the application for grant. One should file it right after company registration Singapore.

SPRING Startup Enterprise Development Scheme (SPRING SEEDS)

SPRING Startup Enterprise Development Scheme (SEEDS) is an equity financing scheme that supports the local startups having innovative idea or product and strong growth prospect across international markets. Spring SEEDS, a subsidiary of SPRING (government agency) co-invests in the startup business along with third-party investor. SPRING SEEDS Capital matches the amount invested by the investor dollar-for-dollar with a maximum limit of $2 million.

TECS (Technology Enterprise Commercialisation Scheme)

The technology-oriented start-up businesses can tap into TECS (Technology Enterprise Commercialisation Scheme), a grant jointly administered by SPRING Singapore and IDA (Infocomm Development Authority). This grant is also suitable for the SMEs planning to conceive their own technology ideas.

The basic eligibility criteria for this competitive grant is that the company must be registered for at least five years with their primary business activities being conducted in Singapore. Through this grant, SPRING provides early-stage funding to the applicant who wishes to develop proprietary technology solutions.

ComCare Enterprise Fund

ComCare Enterprise Fund (ECF) is a cash grant administered by the Ministry of Social and Family Development. It is a seed funding for the social enterprises who train and employ disadvantaged Singapore citizens (senior citizen, less educated persons) to become self-reliant. This scheme has been launched to assist the enterprises that are undertaking social projects. This special fund can finance up to 80% of the capital expenditure and operating cost of a social project up to a maximum cap of S$300,000.

The aspirants wishing to set up a company in Singapore can leverage the funding assistance offered by the government through these grants. With all positive attributes around, Singapore deserves to be called as a business paradise for new and seasoned entrepreneurs. The government has taken a bold step to eliminate the most common obstacle for new entrants i.e. Funding through these series of grants.

[box title=”About the Author” border_width=”1″ border_style=”solid” align=”center”]SBS Consulting is a corporate firm that deals with company registration Singapore related services for entrepreneurs across the world. Apart from company incorporation, the firm also specializes in other domains like accounting, bookkeeping, XBRL filing, GST registration and filing, corporate secretarial services, corporate tax, and payroll.[/box]

SBS Consulting

Latest posts by SBS Consulting (see all)

- GST Filing Singapore: Do It Efficiently with the Help of a Third-party Firm - July 6, 2017

- Singapore Government Grants for Start-ups Drive Global Aspirants to Venture into Entrepreneurship - June 12, 2017

- Company Incorporation Services for Singapore Residents: What are the Popular Options? - May 30, 2017