Making the decision to accept card payments for your business is a crucial one, especially as it’s a decision which can affect everything from the day-to-day running of your company to the generated profit. The benefits of going digital and accepting card payments within your business are beneficial to both you and your customers, with the majority of transactions now happening on-the-go and with the customer expecting speedy processes and a seamless experience.

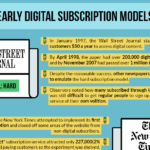

Going digital and accepting card payments for your business will enable opportunity for financial inclusion, as well as potential new customers. The below gifographic, by Total Processing, outlines in a clear and animated design the advantages and disadvantages of accepting card payments and how you go about weighing up your options.

As well as outlining the pros and cons, the animated infographic also goes through some of the digital payment options which you could consider, as well as going into detail on how you can go about adopting digital payments for your business and some potential obstacles which you might face in the process, and therefore need to be aware of.

Wondering why your business should go cashless? Have a look below and find out more about the benefits of cashless payments.

Payments are integral part of the customer experience. If you are employing any form of electronic payment for your business, you might want to look at wider options and maybe even get multiple modes of payments working for you. This would impact your business’s cash inflow. Do share this post around and leave us your comments below!

Natalie Frey

Latest posts by Natalie Frey (see all)

- Cashless Transactions for Small Businesses [Infographic] - May 5, 2017