A common mistake business owners tend to make is to mix their personal finances with the business ones. So when the tax season comes this can lead to a chaotic situation, one which can cause you quite a lot of stress and time you can’t spare. This is why it’s essential that you separate these two pieces of financial life, even if you’re just starting your small business. Here’s our view on how to manage your finances in such a way that they never intervene with each other.

Business Credit Card

This can be difficult because banks often refuse to lend money to smaller businesses, due to them being higher risk clients. Still, you should try to get it and use it as a separate checking account. It will help you keep your financial records immensely, and you’ll also have something to show to the IRS if you ever get audited. There’s also the possibility of having a tax deduction for using a business credit card, so if you’re in a position to get one, do it by all means. Another perk is that you’ll start building your company’s credit history, which is a big deal. If you get a business credit card, you won’t ever need a personal credit card for business purposes again.

Have Separate Checking Accounts

If you haven’t already, the first thing you should do when starting a business is to go to your bank and open a business account. This will make keeping records of your cash flow much easier, which will help you organize and pay taxes when the time comes. You’ll make your business more efficient overall, and you’ll also signal the IRS that you are running an actual business, and not a hobby or a side project – which in turn will get you more of those sweet tax deductions.

Incorporate Your Business

By incorporating your business as an S Corp, C Corp, or LLC (Limited Liability Corporation) not only will you protect your personal assets, but you’ll also get tax benefits out of it. Having a corporate structure is a great insurance for your personal assets, in case you get into expensive lawsuits, losses or business debts. Talk to your accountants and attorneys about which entity is the best for your business and how it’s going to affect your taxes and finances.

Give Yourself a Salary

Instead of just taking what you need from your business account, consider putting yourself on a payroll and making mandatory payroll deductions. This will additionally separate your personal and business finances, as you won’t have to worry about moving money between the two accounts. You’ll also ensure that you’re paying the IRS what you owe through payroll taxes, which is why many accountants Sydney area recommend paying yourself a set salary. If you’re a sole proprietor or an owner of LLC – you won’t be eligible to receive a salary via payroll, which isn’t to say that you shouldn’t set up your withdrawals like paychecks. For the sake of organization, make sure they’re always the same amount and withdrawn at regular intervals.

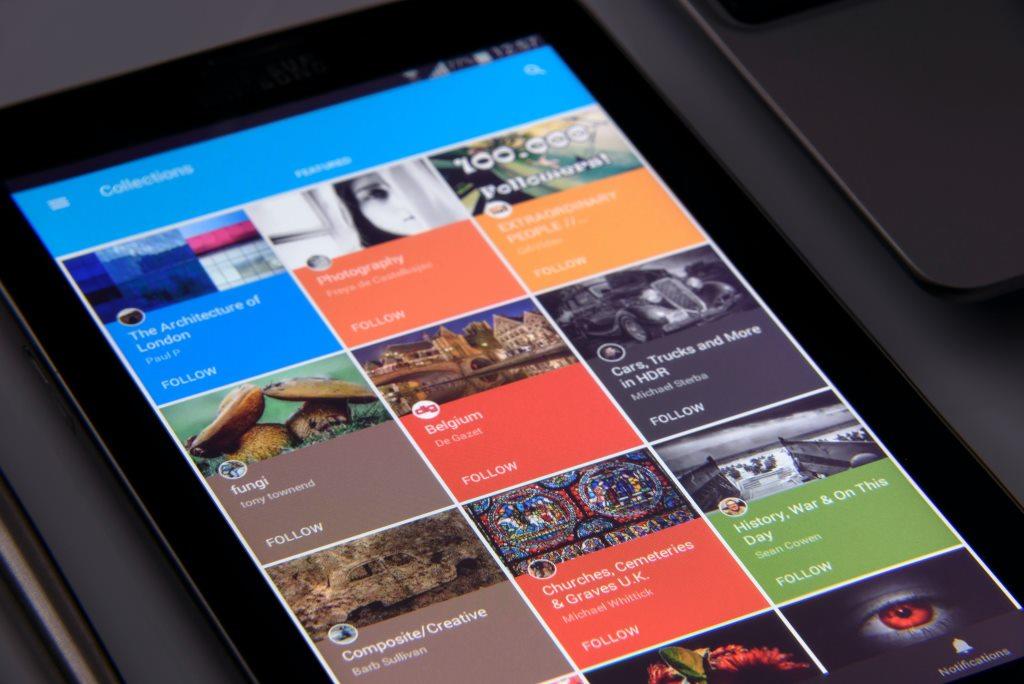

Create a Budget

Having a budget will force you to reconsider the pros and cons of every purchase and financial decision you make. You should have a budget for both your personal and professional life, especially if you’re an impulsive person when it comes to shopping. The best way to actually stick to the budget is to track your spending, which you can do through a number of free apps and programs. That way you’ll know where you’re throwing away money, and what causes you to spend more than your budget allows.

Separating your personal and business life is extremely important, especially when it comes to finances. By keeping track of your spending and staying on top of your finances you’ll make sure to have an easier time when the tax season comes, and you’ll also save some money through tax deductions while doing it. Staying organized is the key element when it comes to finances, so consult your CPA on every decision you’re about to make and consider the potential benefits and consequences of your choices.

Cate Palmer

Latest posts by Cate Palmer (see all)

- Tips for Employers How to Respond to Workplace Injuries - September 24, 2017

- How To Keep Your Personal And Business Finances Separated - August 26, 2017

- Get Found: 7 Local Branding Hacks for Small Businesses - July 30, 2017