Infographic via Complete Web Resources, an Austin-based SEO consultancy and web design firm.

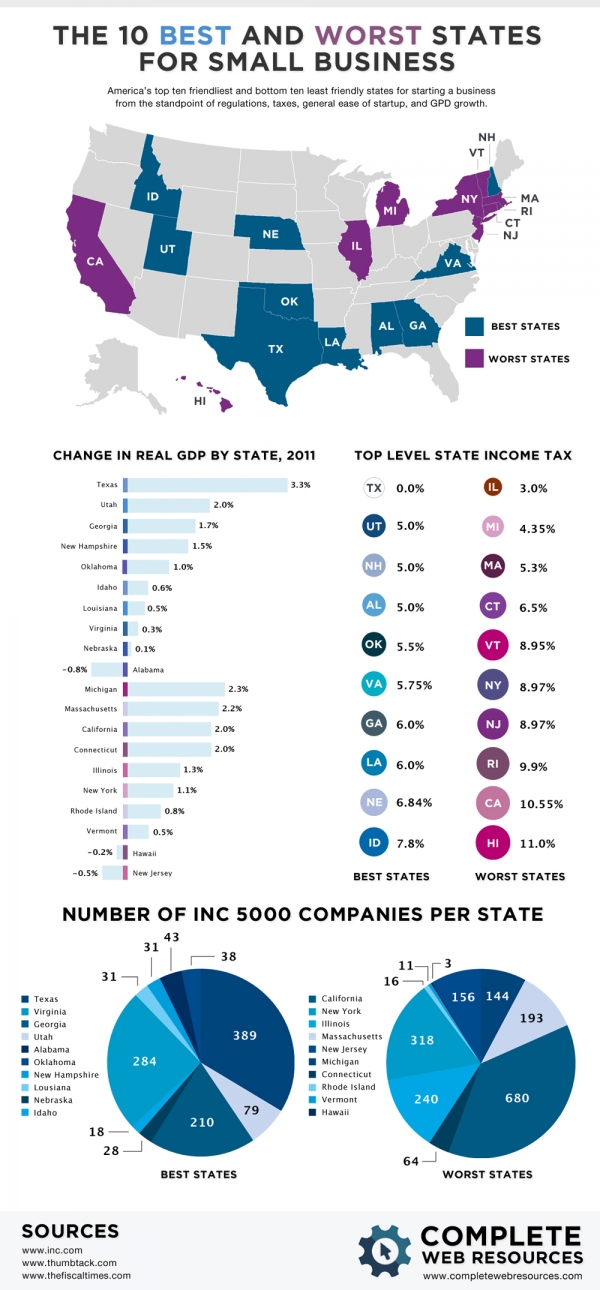

There are a myriad of factors to consider when launching a small business, but many new business owners fail to consider the impact of their state’s business climate on their own business. Thankfully, this infographic breaks down the factors affecting small businesses, such as GDP, state income tax, and the number of INC 5000 businesses operating in each state, providing business owners with an easy-to-digest glimpse of the best and worst states to do business in.

Regardless of whether someone is starting a local brick and mortar business or an e-commerce business, this infographic can be used by business owners to help them throughout the incorporation decision process. They are often overlooked, but state taxes and local economic climates can be a significant burden on the bottom line of small businesses of every nature. In the end, choosing to operate in the right state can mean the difference between success and failure.

The Gross Domestic Product of a state is an economic measurement of all of the services and finished products produced by all of the companies and workers within the state’s borders. Since GDP is the result of a state’s overall business activity, its effect on a business can be relatively minor from one standpoint. However, due to the fact that GDP is a macroeconomic indicator of the strength of a state’s business climate, overall strength of a state’s economy, and the wealth of its workers, it is often used by investors and businesses to determine the efficient deployment of their capital. This useful infographic shows the states with the best and worst GDP, providing insight into the strength of the state’s business climate and the amount of capital that will be needed.

Small businesses not only have federal tax obligations, but they are responsible for paying local and state taxes as well. Since every state imposes its own tax laws, a business in one state may suffer from a heavier tax burden than the same business in another state. Understanding the taxes imposed in each state and the role taxes can play in the success of their business can help business owners discover the states with the best tax environments.

Approximately 90 percent of all businesses are comprised of S-Corps, partnerships, and sole proprietorships, which all file taxes as individuals. Due to this, personal income taxes affect far more businesses than many may think. Since investing and operational costs are affected by these tax rates, states with higher personal tax rates, such as California, have higher operational costs. The infographic below shows the most and least taxed states, and can help numerous business owners determine the best state for their business operations.

Also shown on the infographic is the number of INC 5000 companies operating in each state. By showing the states with the most and least number of INC 5000 companies, business owners can gain a better overall idea of each state’s business environment. After all, if a state has a significantly lower number of thriving businesses than others, there is likely a valid reason behind this.

In addition to these factors, some states may also have additional legislation in place that imposes higher taxes on affiliate marketing and e-commerce businesses than other states. Anyone contemplating a Web-based start-up can use the infographic’s clearly organized data for a quick rundown on the best and worst states for their business.

Infographic courtesy of CWR, a digital marketing refinery and SEO consultancy.